If you’re interested in your financing options for buying or building a home outside a major urban area, you might want to consider the various rural housing loans offered by the United States government. The U.S. Department of Agriculture is an official government organization offering various loans to support communities in rural areas.

Here is some more of the basic information about rural housing loan opportunities:

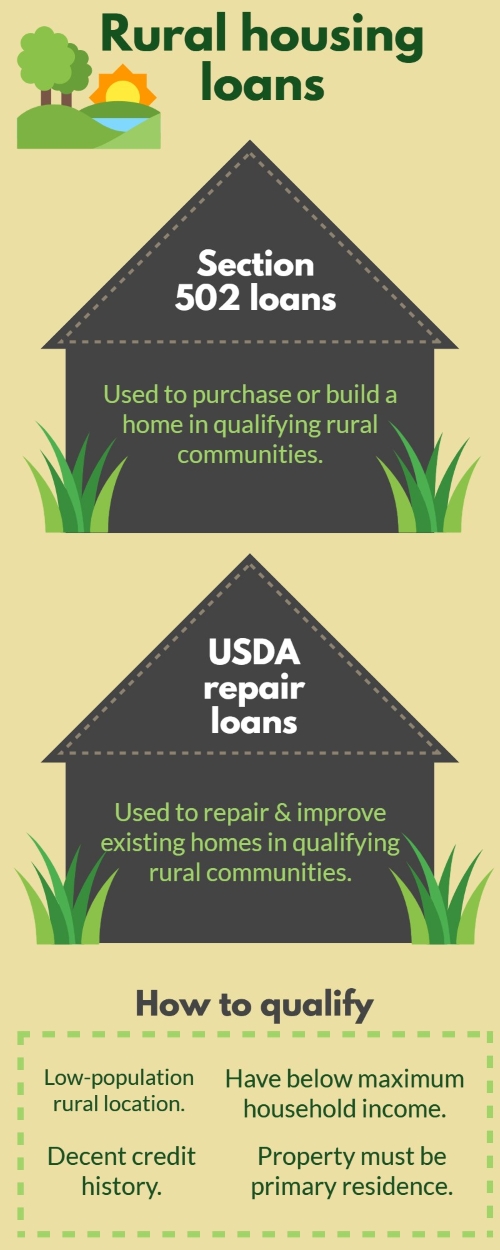

Section 502 direct loans

One of the simplest types of loan assistance offered by the USDA is called a Single-Family Housing Direct Loan Program, or Section 502 loan. With these loans, the government lends the money directly to the homebuyer to buy, repair or build a new home in a qualified rural area.

Section 502 loans don’t require down payments, don’t require mortgage insurance, and typically have low, fixed interest rates. Payment assistance options can even lower interest rates even further.

USDA housing repair loans

Another option for rural housing is through the Section 504 Home Repair loan program. The USDA offers these loans to help potential homeowners bring home codes up to current standards, make necessary repairs, and address any safety or health issues with a property.

Determining your eligibility

How do you know if you’re eligible for a rural housing service home loan? There are some key factors determining eligibility, such as:

- The location of the home you want to purchase or repair has to be in a low-population area.

- An applicant’s household income must be below a certain threshold.

- The applicant needs to show proof of credit history, though the minimum credit score is much lower than many other types of loan.

- The property has to be used as a primary residence.

Is a rural housing loan right for you? While these are just the basic facts about direct loans and other government-sponsored housing programs, this information can help you determine whether you might qualify.

About the Author

Matt Mihalcin

Matt has been in Real Estate since 2006 in the Denver area. He is a 3rd generation Colorado native of 30+ years who currently lives in Broomfield. He leverages his experience and network to save clients time and money for easy and low stress transactions. He enjoys mountain biking, skiing and hiking in his free time.